In April 2023, the General Administration of Customs of the People’s Republic of China released trade data for March, providing a comprehensive picture of the country’s green petroleum coke (GPC) import landscape for the first quarter of the year. This data presents an opportunity to reflect on the import trends over the past three years, a period marked by significant highs and surprising lows.

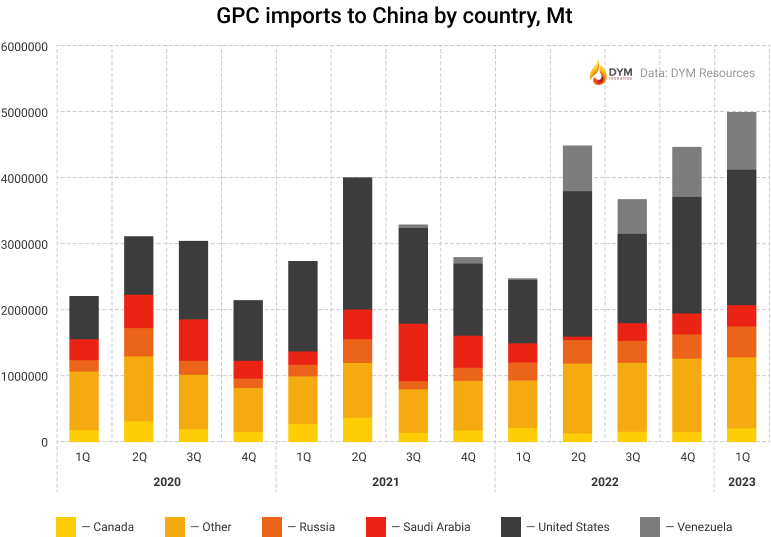

In 2022, China imported a staggering 15 million tons of petroleum coke, a 2-million-ton increase from the previous year and a whopping 4.5 million tons more than the 2020 figure. This surge in import volumes has led to an unprecedented build-up of petroleum coke stocks in Chinese ports. Reports at the end of April cited nearly 5 million tons of stock, a significant leap from the average levels of previous years, which barely exceeded 1.5 million tons.

Over the years, China has established itself as the largest importer and consumer of petroleum coke, fueled by its role as the world’s leading producer of primary aluminum – a key industry that primarily consumes low-sulfur sponge coke. The rise in import volumes in 2021 and 2022 can be attributed to growing traders interest in the commodity amid soaring commodity prices.

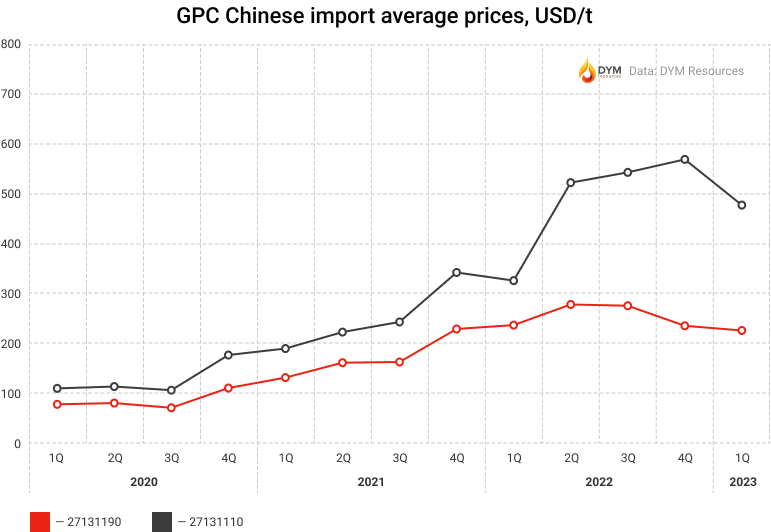

However, the massive inventory build-up has triggered a domino effect, cooling the market and causing prices to fall. This price decline for imported petroleum coke in China will become more apparent in subsequent reporting periods.

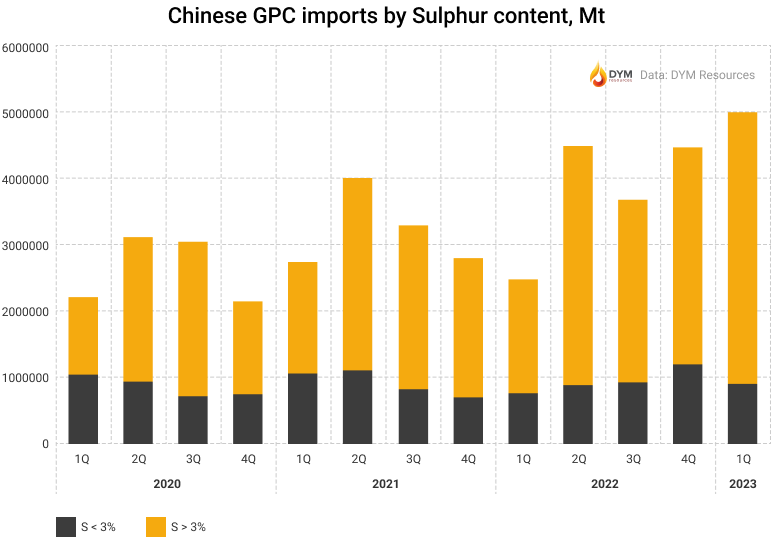

Interestingly, the import of petroleum coke with less than 3% sulfur content has remained relatively stable over these three years, averaging between 3.5 to 3.7 million tons. On the other hand, the import of petroleum coke with more than 3% sulfur content has seen a substantial increase.

This trend suggests that while the import of low-sulfur petroleum coke has maintained its previous levels, high prices have prompted consumers to include calcinable sponge coke with sulfur content up to 4%, and sometimes higher, in their production processes. Thus, it’s difficult to assert that the import of anode-grade coke has consistently stood at 3.5 million tons over the past three years.

Overall, the past three years have brought a whirlwind of highs and lows for the import of petroleum coke into China. With volatile market conditions and shifting consumer behaviors, the landscape of this critical commodity continues to evolve. As we move forward, it will be interesting to see how these trends develop and what new dynamics emerge in the petroleum coke market.